Luxury travel has many faces. Not long ago luxury travel meant “traveling in style” through first class transportation, plush hotel accommodations, and the table of choice at five-star restaurants. Luxury travel was a state of mind and lifestyle few people could achieve. That was then, and this is now.

According to the L.E.K. 2017 Luxury Travel Study — a survey of nearly two thousand U.S. travelers — the face of luxury travel is changing once again and becoming a form of travel many of us can now step into as we go.

Across-the-board pampering may no longer be everyone’s goal, as the definitions for “what is luxury” evolve into a kaleidescope of changing tastes and preferences. But one thing remains consistent: people are willing to spend generously on those aspects of luxury travel that matter to them the most.

Three Faces of Luxury Travel

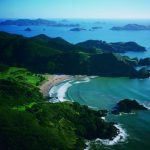

As the definition of luxury continues to evolve, today’s “luxury traveler” is just as likely to be a Millennial in search of an eco-vacation who is willing to sleep in a bunk bed, as it is to be wealthy globetrotter seeking comprehensive amenities and services. The L.E.K. study demonstrates that a far broader range of people are eager to make trade-offs to fund luxury, splurging on some items while scaling back on others.

- Elite: High on the “indulgence spectrum”; tend to require luxury across their entire travel experience

- Aspirational: Willing to indulge in high-end experiences in specific situations

- Prudent: More likely to be budget stretchers; nevertheless, will partake in limited luxury travel from time to time

Each of these groups views luxury through a different lens, and each has a different set of priorities, opening up a range of market segmentation opportunities.

Modern luxury travel is now the leading channel for discretionary spending

Across all luxury categories, travel is now the top outlet for indulgence. Nearly half (49%) of U.S. travelers indicate that they are likely to splurge on travel, followed by dining out (43%) and food and wine at home (36%). By comparison, traditional luxury categories like apparel and accessories (30%) and jewelry (20%) trail travel by a considerable margin. Interestingly, this trend appears to be growing. Younger generations embrace the concept of the “travel splurge” more than the cohorts that preceded them, with nearly two-thirds of Millennials admitting to indulging in luxury travel in some form. Given that the appetite to splurge is inversely correlated with the financial wherewithal that comes with age, younger groups, in particular, are learning to be selective in their approach to luxury travel.

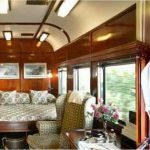

The definition of luxury increasingly revolves around experiences. Across the travel spectrum, luxury has traditionally been defined by “quality of product.” Ratings from third parties ruled the day, with Michelin, Zagat and Condé Nast setting the tone for what should be viewed as rarified and special. While physical product characteristics are, and will always remain, critical, many of the defining characteristics of luxury now center on “quality of experience.”

Luxury travel is increasingly accessible. More and more people are gaining access to at least some elements of luxury travel. For example, while fewer than 10% of survey respondents consider themselves luxury travelers, nearly 85% say they indulge in travel luxuries at least once in a while. When looked at this way, the premium travel market has broadened significantly, but it is due to the fact that a much wider variety of people are spending selectively.

Choice Powers Personalized Luxury

To access this much larger market, providers must develop ways for more mainstream clientele to “toggle” into luxury elements. Critical attributes might be calibrated to the “Goldilocks” (or “just right”) level of luxury for the individual. In practice, we are observing more “Uber when you need it” in place of a town car for the day. For suppliers, it means embracing the “age of the upgrade,” overlaying better/best options on top of modest bases (e.g., opportunities to trade up to extended legroom, a suite or white glove service). The research revealed significant increases in willingness to spend more on selective calibration. The more experiential the element (for example, dining or activities), the greater the change in mentality compared with even five years ago.

Power of Brands

The signaling power of brands has not diminished. A number of recent studies have cited the declining influence of brands, particularly with Millennials. However, the survey suggests the opposite is true in the luxury travel space; rather, brand recognition remains a significant factor in luxury travel purchase decisions, and its influence is growing, especially among Millennials. The increasing importance of brands is greatest among the Elite traveler segment. Therefore, while there is an opportunity for unique experiential offerings to challenge established luxury brands, upstarts will have their work cut out for them.

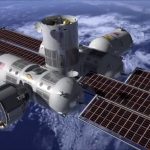

Brands must offer convenience without compromising exclusivity. Given these findings on brand importance, what is it that today’s travel brands should actually be communicating? In the past, opulence, quality and pleasure were typically emphasized. However, the modern luxury travel brand must also demonstrate two essential characteristics (which are sometimes at odds). The first is convenience. Technology has conditioned people to expect removal of life’s frictions, and luxury embodies what people expect in a seamless or effortless experience. Lack of free time in today’s society only amplifies this need. The second essential characteristic is exclusivity. Greater investment in luxury travel comes with a commensurate expectation of rarity. Instead of collecting objects, the affluent (and those who aspire to affluence) are collecting experiences. And to the extent luxury travel becomes a life-affirming action, people want to see that their investment in it distinguishes them. Their experience should be the envy of others.

Harnessing the Desires of Millennials

A younger muse is inspiring luxury innovation. Millennials are increasingly the drivers of demand for luxury. More than three in five Millennials surveyed (61%) said they either choose full or selective luxury travel, compared with 48% of Gen Xers and 35% of Baby Boomers. Inspired by Millennials’ interpretation of luxury, brands ranging from traditional players like the Four Seasons to relatively new entrants like Airbnb are experimenting with offerings that cater to younger travelers who are seeking “the right experience.” However, many older consumers are also developing more adventurous palettes, influenced by the tastes and preferences of younger cohorts. While hipsters may have prompted the trends toward artisanal cocktails and curated travel immersion activities, Baby Boomers are discovering, and paying for, these innovations as well.

Millennials amp social currency with “prestige moments.” For members of the selfie generation, the ability to capture “in the moment” prestige experiences and share them with their social network is extremely important, and key to building a personal brand. Perhaps nothing is as powerful as travel in communicating that you are connected, worldly and exciting. Suppliers in the industry should embrace this mindset by offering experiences that help enable and activate it. If an agency, a hotel brand or a tour operator can help plunge guests into what is perceived to be an authentic moment, it will clearly be valued.

Playing for Premium Travelers

Modern premium travel is now a sector up for grabs. Overall, these findings suggest we are in a period of flux for premium travel. Evolving perceptions of what luxury means are unlocking tremendous opportunities for brands not traditionally associated with across-the-board luxury, creating the potential for disruption of established luxury travel brands. Players lower on the brand scale will need to identify luxury elements in their offerings that can be made available to people who are willing to splurge selectively. At the same time, brands matter. Traditional luxury players that are able to update their offerings and create a diversity of choice, and thus attract a broader range of customers, could well continue to dominate.

Selective Indulgence: The Changing Market for Premium Travel – complete study.

Related Stories:

Get Social